If you have relatives over the age of 70 who are still managing their finances there is a very good chance that one of them has been scammed in the last year. Ongoing research has shown that as we grow older we lose our edge in suspecting and avoiding fraudulent people. Some scam artists are even targeting the elderly with on-the-spot memory tests to see how well they can recall past or imaginary negotiations.

This research is scary and everyone with an elderly family member should sit down with other adult members of the family and discuss the risks that the elderly face. Sooner or later we will all be those elderly relatives who are preyed upon by unscrupulous people.

Here are four articles that share alarming facts about how scam artists take advantage of our elderly.

In 2005 the American Psychological Association published a study that showed people over the age of 70 are less likely to remember important details of financial transactions, and that they may even be vulnerable to simple manipulation by unscrupulous contractors who deliberately lie about agreed-upon prices and deals.

To help elderly people avoid being deceived by lies the study authors suggested that we all keep receipts and records, including price quotes. If you cannot find the paperwork to back up whatever someone says you agreed to then you do not pay them. But it is also a good idea to have your repair work and other purchases, or decisions about borrowing money, reviewed by a younger member of the family who won’t benefit from the transaction.

Our ability to form or accept false memories increases with age. Although this is due to declining brain functions it does not mean that our elderly relatives are incompetent and ready to be put into retirement homes. It just means they need to be more cautious about making financial decisions in the company of strangers.

In 2012 a study published by the National Science Foundation found that people who have a higher social status are far more likely to engage in unethical behavior than “average” people. Elderly people are more easily influenced by people of higher social status, so this is a double-whammy for our aging population. We should school ourselves (and our elderly relatives) to distrust any special offers made by people who appear to be wealthy and successful.

This is contrary to the marketing practices of presenting an outward appearance of success, but such caution will only be effective against high-end marketing. The lowly con artist may in fact present himself as a down-on-his-luck “average” guy who just needs a little help. People who leverage their social position to sway elderly customers into making bad decisions use high-pressure tactics, repeatedly assuring their elderly victims that everyone is taking advantage of the great offer.

Society teaches us to trust those in higher social circles more than those in lower social circles, but as any frequent movie-goer can tell you the bad guys are often the ones who have the most money and the most expensive cars. This stereotype is not a good model for making lifelong decisions; but it serves as a cautionary tale for everyone entering the aging population to remember to be skeptical of everyone who assumes you trust them.

In fact, a 2012 UCLA study found a physiological reason for why elderly people are more easily deceived than younger people. The region of the brain that fires off our “gut feeling” that someone is lying to us becomes less active after about age 55. Since at least one of the mechanisms that protects us against falsehood becomes less effective as we grow older we have to compensate by relying more on younger relatives who are not trying to take advantage of us.

But it may also be helpful to teach ourselves (and our elderly loved ones) to take extra time to make financial decisions. It would even be a good idea to discuss a possible purchase, loan, or investment with someone who does not stand to gain anything from the transaction. But that alone may not be enough. After all, if an elderly relative is already thinking about going through with such a transaction someone has won over their trust. Destroying that trust may be difficult; worse, the financial damage may already have been done.

For example, if your relative has taken out a high-interest signature loan with no real need to do so you may need to come up with alternative financing to pay off the loan quickly. If your relative is a member of a credit union the credit union may be able to help. But this is just one example of how strangers can take advantage of the elderly before younger relatives can intervene.

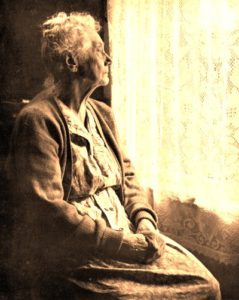

But what may be most disturbing is that there are subgroups of the elderly population who are more likely to make bad financial decisions. A study published by Wayne State University shows that elderly people who are depressed or who feel lonely are more likely to fall prey to financial scams. These are people are more vulnerable to manipulation than happier, more engaged elderly people. Undoubtedly the scam artists hone in on lonely or depressed people who long for social company and validation as individuals, taking advantage of these psychological states of mind that may impair judgment.

What can we do now for our elderly relatives? Here are a few suggestions:

- Spend more time with them

- Be patient in listening to what they say about impending financial decisions

- Suggest practical alternatives when they talk about dangerous financial decisions

- Help them find social activities to keep them engaged

- Assist them with their budgets, or find someone who will do it fairly

- Show them that they are loved

When families stayed together across generations it was easier for younger relatives to share the responsibility of watching over the elderly, who in turn were able to impart vital love and wisdom to their families. Although this may seem like a taxing struggle for individual children and grand-children the reward of spending time with family will be complemented by the reduced stress that comes with protecting the elderly from scam artists.

If your relations with older or younger family members are strained you always have the choice of seeking counseling to help you understand your feelings and learn how to moderate them in stressful situations. Your goal should be to take more joy in spending time with your relatives and not focusing on the anxieties that may arise from being a primary or secondary caretaker (or from being assisted by younger family members).

We need to learn to protect ourselves while we are young by building stronger bonds with our families, staying socially involved with other people, and learning to appreciate our innate self-worth. Remember your grandmother’s favorite saying: an ounce of prevention is worth a pound of cure. Our elderly relatives still have much to share with us, and we can learn from the experience of helping them so that when our turn comes we can advise our younger relatives on how to help the elderly.